Merchants can't collect evidence required by VAT laws if they use Bitcoin

https://www.gov.uk/government/publications/vat-supplying-digital-services-and-the-vat-mini-one-stop-shop/vat-supplying-digital-services-and-the-vat-mini-one-stop-shop

1) "Billing address" not verified with credit/debit card or by any other means. Is this evidence?

2) IP address (if merchant is not using TOR hidden service or similar technology). Is this evidence? It is laughable easy for customer to use proxy server or VPN in other country.

3) Customer can give his phone number. But merchant can't verify where this phone number is located. And product will cost more, because there is need to pay for a call center for verifying phone numbers! This will increase the product price with about $1-$5 (this is the price of one phone call). There is no way for merchant to know if customer is using some online phone number.

So, it is most likely that merchant will collect these two evidence:

1) IP address (no way to confirm that no proxy is used).

2) Phone number (no way to confirm phone number has SIM card and not online number).

Is this qualify as "evidence"?

Discussion on Reddit: http://www.reddit.com/r/Bitcoin/comments/2mlwge/merchants_cant_collect_evidence_required_by_vat/

Related: Merchants can't collect evidence required by VAT laws if they use Bitcoin

Once you have 2 pieces of non-contradictory evidence that is all you need and you don’t need to collect any further supporting evidence.

- the billing address of the customer

- the Internet Protocol (IP) address of the device used by the customer

- location of the bank

- the country code of SIM card used by the customer

- the location of the customer’s fixed land line through which the service is supplied to him

- other commercially relevant information (for example, product coding information which electronically links the sale to a particular jurisdiction)

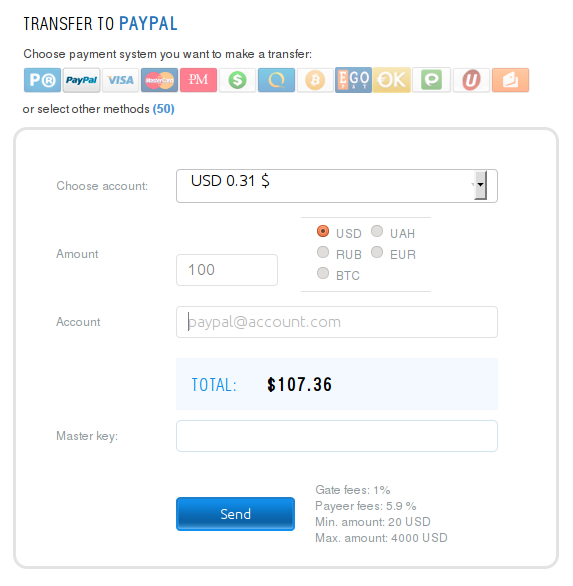

- There is no "billing address" because there is no credit card! Billing address is not associated with Bitcoin.

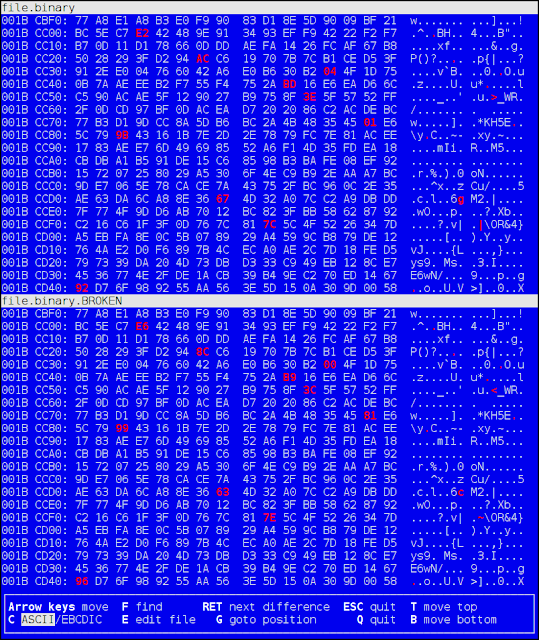

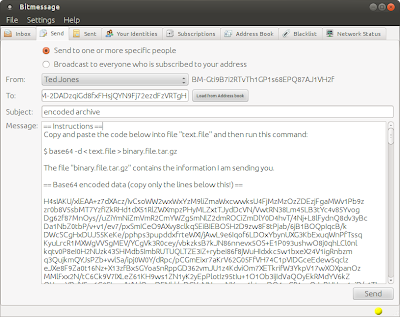

- The IP address is not shown if merchant is selling digital products using TOR hidden service or other protocol, not showing customer's IP address.

- There is no bank.

- There is no need of using telephone when purchasing digital services. Almost all customers will refuse to give their phone number. Also, the telephone may work without SIM card (e.g. old telephone with cable).

- There is no "fixed land line through which the service is supplied" to the customer.

- There is no product coding and other bullshit.

1) "Billing address" not verified with credit/debit card or by any other means. Is this evidence?

2) IP address (if merchant is not using TOR hidden service or similar technology). Is this evidence? It is laughable easy for customer to use proxy server or VPN in other country.

3) Customer can give his phone number. But merchant can't verify where this phone number is located. And product will cost more, because there is need to pay for a call center for verifying phone numbers! This will increase the product price with about $1-$5 (this is the price of one phone call). There is no way for merchant to know if customer is using some online phone number.

So, it is most likely that merchant will collect these two evidence:

1) IP address (no way to confirm that no proxy is used).

2) Phone number (no way to confirm phone number has SIM card and not online number).

Is this qualify as "evidence"?

Discussion on Reddit: http://www.reddit.com/r/Bitcoin/comments/2mlwge/merchants_cant_collect_evidence_required_by_vat/

Related: Merchants can't collect evidence required by VAT laws if they use Bitcoin

Comments

Post a Comment