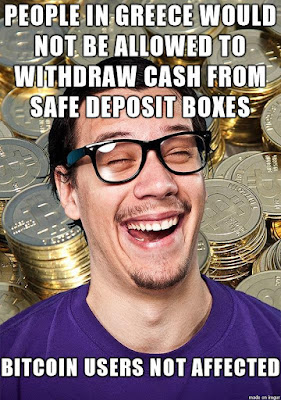

Bitcoin conspiracy

What if a few people like Ver or Gavin realized that if Bitcoin ever actually looked like it was going to succeed the banking industry would spend billions of dollars to stamp it out or that rapid adoption could actually be very bad for society and mankind as a whole? In either of these cases, Bitcoin would have to constantly look like it was on the brink of failure even though adoption was increasing. This would serve to slow adoption to a manageable rate as well as keep the corrupt banking and fiat system from bothering to get involved until too late. How would I do this? First, you have to keep the actual conspiracy small otherwise the jig is up. But then how do you get co-conspirators who aren't actually co-conspirators? Make it about something else, a competing client. OK, great. But you really need to stop people from actually wanting the client. How do I do that? Easy, I will make it complete shit and a totally obvious guarantee of failure to anyone technical. Uh oh, they