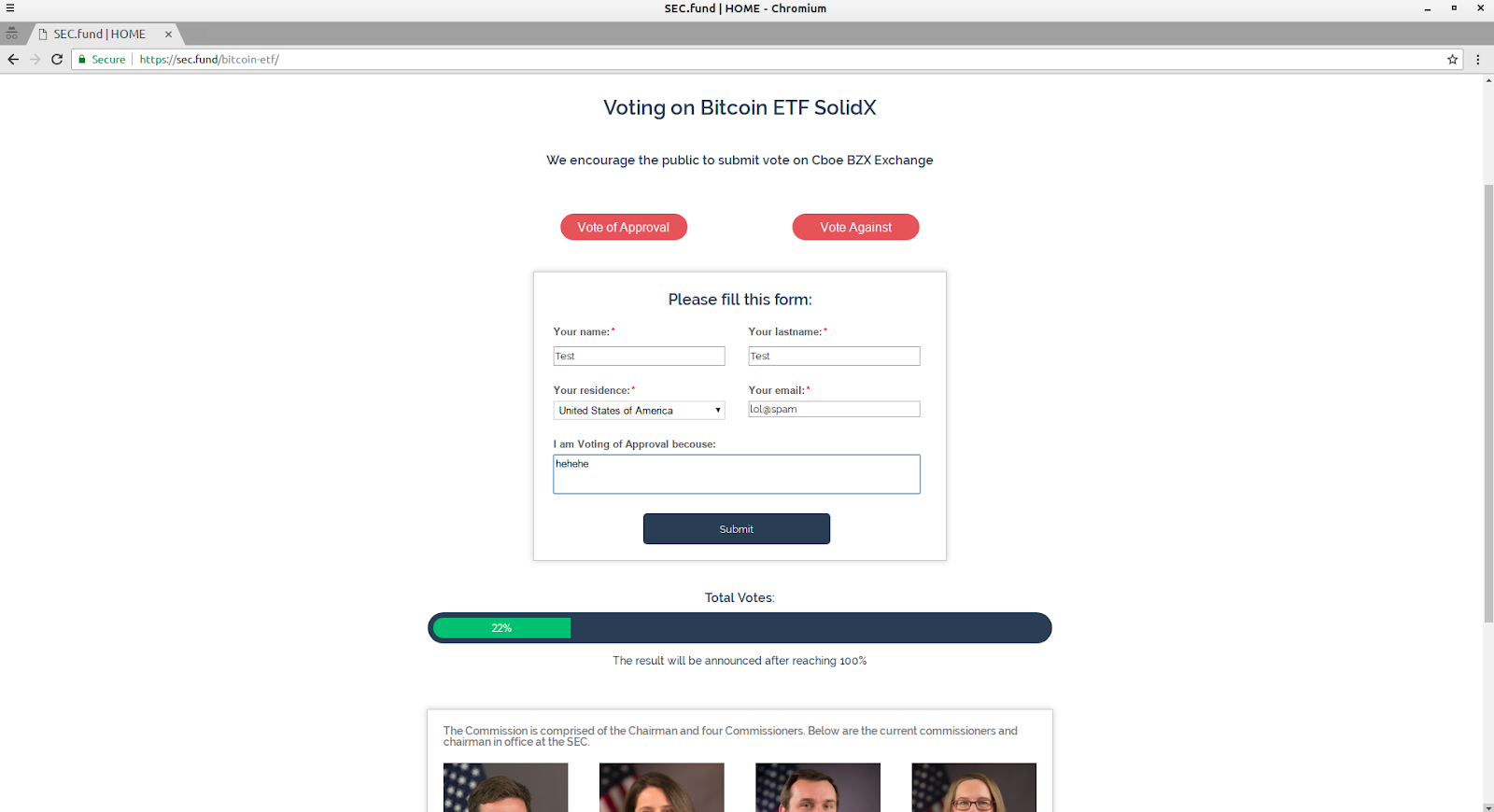

How Bitcoin is being manipulated

SEC is manipulating the price by delaying/denying/approving Bitcoin-related ETFs. China is manipulating the price by "banning Bitcoin" again and again. India is manipulating the price by "banning Bitcoin" again and again. Every buyer, seller and hodler is manipulating the price by buying, selling and hodling. Every person writing about Bitcoin on social media is manipulating the price. Every person talking about Bitcoin is manipulating the price. The media is manipulating the price of Bitcoin by promoting it (display BTC price in a way they display the oil price, talk about Bitcoin, make documentaries about Bitcoin). Everything is a manipulation.